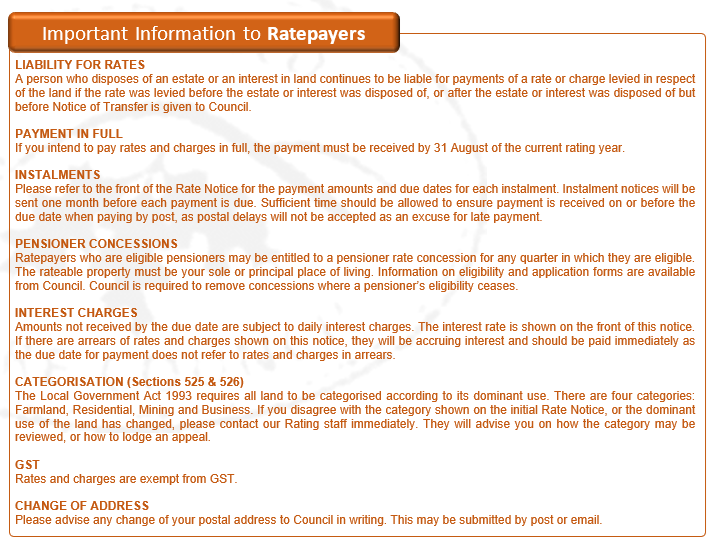

Important Information for Ratepayers

Council Rates and Rating Model

Councils help local communities enjoy a quality life. They administer various laws and regulations to help maintain and renew services and facilities for the community. These services include roads infrastructure, sporting facilities, recreation facilities like parks and playgrounds, library, environmental planning, public health, environmental protection, and waste collection, treatment, and disposal. The rates you pay allow your council to fund these facilities and services.

Each year the Tenterfield Shire Council is required to determine the combination of rates and fees and charges needed to fund the services it provides. The information on how Council determines rates, charges and fees is contained in the Statement of Revenue Policy which forms part of its annual exhibited Operational Plan. To find the most recent plan go to https://www.tenterfield.nsw.gov.au/your-council/council-documents

Rate Calculation Process

Land Values – Set by the Valuer General based on the unimproved land value, excluding any buildings and improvements.

Rate pegging – This is the maximum percentage amount set by the Independent Pricing and Regulatory Tribunal (IPART) by which a Council may increase its general income for the year. The primary purpose of the rate peg is to protect ratepayers from excessive increases in their rates bills. For the 2025/26-Financial Year, an overall rate increase of 5.2% is applicable to Tenterfield Shire Council.

Rate pegging applies to Council’s overall general income and not to rates on individual properties. It is possible for some rates to increase more than the rate peg percentage while other may increase by less than the rate peg percentage. In some cases, rates may decrease from the previous year.

Base Rate – This is an amount every landowner pays. It should be sufficient to cover the cost of common services as well as basic general administration costs.

Ad Valorem Rate – This is a number which is used to determine how many cents in the dollar of the unimproved land value a ratepayer will pay. It is the same for each land parcel within a rating sub-category.

Ad Valorem Amount – This is the rate multiplied by the unimproved land value.

Rating Categories and Sub-Categories

New Sub-Category – Residential Rural

The lifestyle blocks that now make up this subcategory were previously included in the rating category “Residential Other” at a low base rate, and the yield achieved was low in comparison with e.g., the “Tenterfield Residential” and “Farmland” rating categories. Therefore, the old rating model was not equitable, as services provided to these blocks were in effect subsidised by other rating categories. The rate changes in this sub-category will be phased in over two (2) years, to lower the impact of this increased rate on ratepayers in this rating category.

The new Sub-Categories are:

- Residential Rural – 2–40 hectares (ha) located outside a centre of population

- Residential Other – 0-2 ha located outside a centre of population.

New Sub-Categories – Business Industrial

These industries were previously spread across various sub-categories. The types and level of services required by Industry are different to general business as they are primarily used for manufacturing, distribution and other heavy industries and are often located away from residential areas. They have specific regulations particularly around noise, emissions, and safety. By nature of their business, they generate more heavy vehicle traffic with a higher impact on infrastructure in comparison to retail businesses. Council needs to maintain this additional stress on the infrastructure and rate these industries accordingly.

These changes have been implemented to achieve a fair and equitable rating model.

| Category | Application of Rating Category | |

| Farmland | In addition to farming being the dominant use of the land, the farming use must also have the following characteristics:

a) it must have a significant and substantial commercial purpose or character, and b) it must be engaged in for the purpose of profit on a continuous or repetitive basis (whether or not a profit is actually made). |

|

| Residential | Land that is used, or has the potential to be used, for residential purposes | |

| Business | Land that is used, or has the potential to be used, for commercial purposes, which includes land that cannot be categorised as farmland, residential or mining. | |

| Mining | The dominant use of the land is for mining (excavation for the purpose of getting minerals). | |

| Residential Sub-Category | Business Sub-Category | |

| Tenterfield | Tenterfield | |

| Tenterfield Urban | Jennings | |

| Jennings | Drake | |

| Drake | Urbenville | |

| Urbenville | Other | |

| Other – less than 2 ha located outside a centre of population | Industrial – land that is used or has the potential to be used for industrial purposes | |

| Rural – 2 – 40 ha located outside a centre of population | ||

If you disagree with the category shown on your rates notice, or the dominant use of land has changed, please contact Council on 02 6736 6000.

Concessions are available for pensioners. You can only claim a concession on the property if it is your sole/principal place of residence. Eligible pensioners are entitled to a rebate of $250 for rates and a subsidy of $87.50 each for water and sewerage.

Water, Sewer & Waste Charges

Water Charges – have been reduced by 12.5% for the 2025/26 year.

Sewer Charges – have been reduced by 10% for the 2025/26 year.

Waste Charges – no changes in 2025/26 year.